Comprehensive insurance is an essential aspect of automobile coverage that protects your vehicle from damages not caused by collisions. This type of policy covers incidents such as theft, natural disasters, vandalism, and animal-related accidents, making it a crucial safeguard for many car owners.

Key Takeaways

Protection Beyond Collisions: Comprehensive insurance covers damage resulting from theft, weather-related events, and other unforeseen circumstances.

Loan Requirements: If you finance a vehicle, lenders often require both comprehensive and collision coverage.

Considerations for Older Vehicles: If your car has depreciated significantly, purchasing comprehensive insurance might not be cost-effective.

Cost-Saving Strategies: Raising deductibles can help lower premiums, making the coverage more affordable.

Understanding Comprehensive Insurance

Comprehensive insurance is one of three primary components of an automobile policy, alongside collision and liability insurance. While liability insurance is mandatory in most states, comprehensive and collision coverage are optional unless required by an auto loan lender. Additionally, some policies may include uninsured motorist or gap insurance for extra protection.

What Comprehensive Insurance Covers

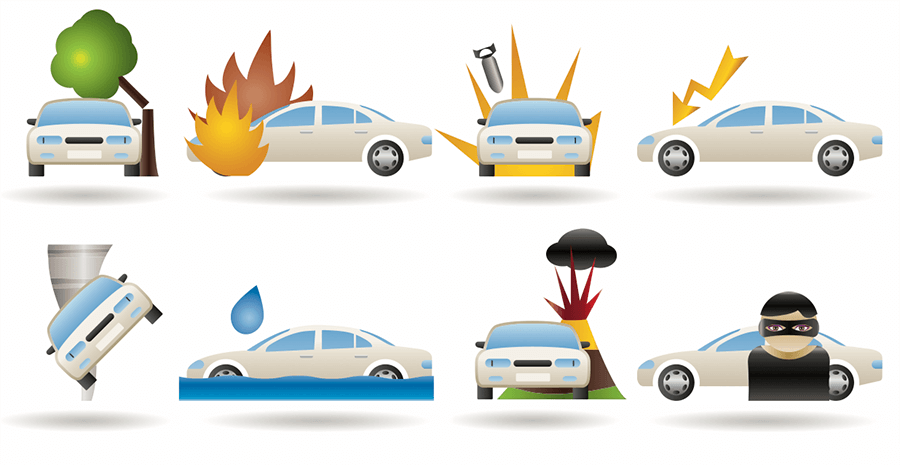

Comprehensive insurance provides coverage for damage caused by:

Animal collisions (e.g., hitting a deer)

Natural disasters (e.g., floods, hurricanes, earthquakes)

Fire damage

Vandalism and riots

Vehicle theft

Broken windshields

Falling objects (e.g., hail, tree branches, rocks)

Comprehensive vs. Collision Insurance

Comprehensive insurance protects against damages unrelated to direct collisions, such as theft and weather-related incidents. Conversely, collision insurance covers accidents involving other vehicles or stationary objects. It is particularly useful if you lease a vehicle or reside in high-risk areas for accidents or road hazards. Notably, neither policy covers medical expenses or damage to another driver’s vehicle.

Cost of Comprehensive Insurance

The cost of comprehensive insurance varies based on several factors, including:

Location: Premiums are higher in areas prone to theft or natural disasters.

Vehicle Value: Expensive cars cost more to insure.

Deductibles: Higher deductibles lead to lower premiums.

The average annual cost of comprehensive insurance is approximately $134 but can vary depending on the state and individual risk factors.

Pros and Cons of Comprehensive Insurance

Pros:

Covers non-collision damages like theft, vandalism, and natural disasters.

Protects new cars from unforeseen events.

Provides financial security for costly repairs.

Cons:

Does not cover collision-related damage.

Might not be cost-effective for older vehicles.

Personal belongings inside the car are not covered.

Example of Comprehensive Insurance in Action

Suppose you own a $10,000 Honda Accord with a $1,000 deductible. If a tornado destroys the car, your insurer will reimburse you $9,000. Without comprehensive coverage, you would have to cover the entire loss out-of-pocket.

Is Comprehensive Insurance Worth It?

If you are financing a vehicle, comprehensive insurance is usually required. However, for older, fully-paid cars, dropping comprehensive coverage may be a viable cost-saving strategy, especially if the vehicle’s value is lower than the deductible.

The Bottom Line

Comprehensive insurance is a valuable safeguard against non-collision-related damages. While it may not be necessary for every driver, it provides financial protection against theft, natural disasters, and other unexpected events. Before purchasing, evaluate your vehicle’s value, risk factors, and budget to determine if comprehensive coverage is right for you.